Watch out: You will Pay Dearly for Skipped Credit Card Payments

By Harald Linkels

Kralendijk- Many credit card holders at our local banks are in for an unpleasant surprise: the interest and other costs simply continue to mount on payments owed on your credit card.

It seemed like a nice gesture from the banks: where normally the debit automatically takes place towards the end of the month, nothing has been taken out of accounts for credit card payments since the start of the Corona crisis. What hardly anyone seems to realize is that the interest on the outstanding amount, depending on the type of credit card and the bank concerned, varies from 18 to almost 22% and continues to be added to the total debt.

High cost

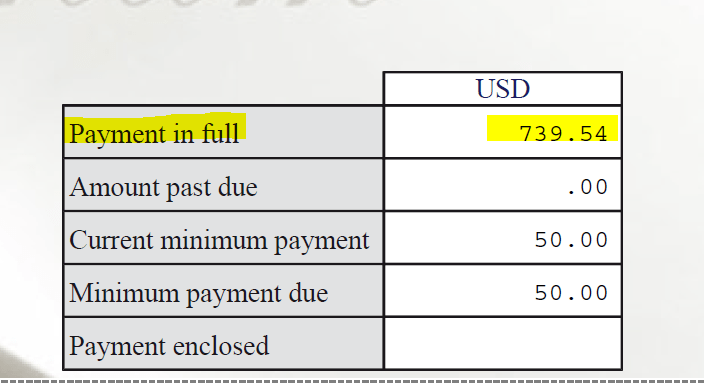

Unpaid credit card charges add up real quick, because of a 18% finance charge on an annual basis. This is the most expensive type of lending at the bank. A personal loan, mortgage or even overdraft facility are in general (much) cheaper than that.

Another thing to keep in mind is that the interest is added onto the original amount owed. So, before you know it, you will be paying ‘interest on interest’. The example above is the most favorable case. There are banks that charge more than the 18% used in this example.

What can you do?

Even if the bank does not debit your account for credit card payments, like they normally do, it is possible to pay towards your credit card balance out of your own. In most cases, and for sure in the case of MCB/WIB, this is possible through your online banking. After logging in, just go to Bill Payment and you can select MCB/WIB Credit Card Payment (USD). Enter your credit card number and pay the amount you owe, or the amount you can spare. Any payment on the amount owed, even if it is 100 or 200 dollars, will save you quite a lot in future interest charges.

Check with the bank

Are you in doubt about the policies your bank applies when it comes to the moratorium on Credit Card payments, or the making of spontaneous payments towards your balance? Then it is a good idea to call them and find out. You will be avoiding unpleasant surprises later on.

Also for business accounts

What has been described above also applies to business credit cards. Everything you pay now will save you quite a bundle at the end of the moratorium. Remember that Credit Card interest is way higher than what you normally pay in a loan or even in a so-called ‘revolving facility’, or overdraft costs.